The last few years have been tough on the economy, and especially to our small businesses. Business owners everywhere are working with tighter budgets, and many programs or activities that don’t directly benefit the bottom line are getting cut, or at best, reduced.

What to cut and what to keep? No doubt, this is a tough balancing act for any manager as there are many pros and cons for each budgetary decision. In too many cases, safety ends up in the “cut camp”, whether it’s reducing safety equipment expenditures, personnel, or training.

What to cut and what to keep? No doubt, this is a tough balancing act for any manager as there are many pros and cons for each budgetary decision. In too many cases, safety ends up in the “cut camp”, whether it’s reducing safety equipment expenditures, personnel, or training.

The reason for this is undoubtedly due to the basic nature of being safe – if everything goes as it should, it’s business as usual with no accidents and no injuries. This makes it difficult to know whether the money you are spending on safety is really having an effect. So what can happen in economies like this, when budgets are tighter, is that complacency can set in, and this area of the P&L gets trimmed.

The main argument for safety is obvious – to help protect your workers from injury and death. But keeping safety programs, equipment, and training in the budget can also be the less expensive route. Here, we’ll discuss why it’s so important, from a financial perspective, to make sure your workers have every possible means of safety protection available to them.

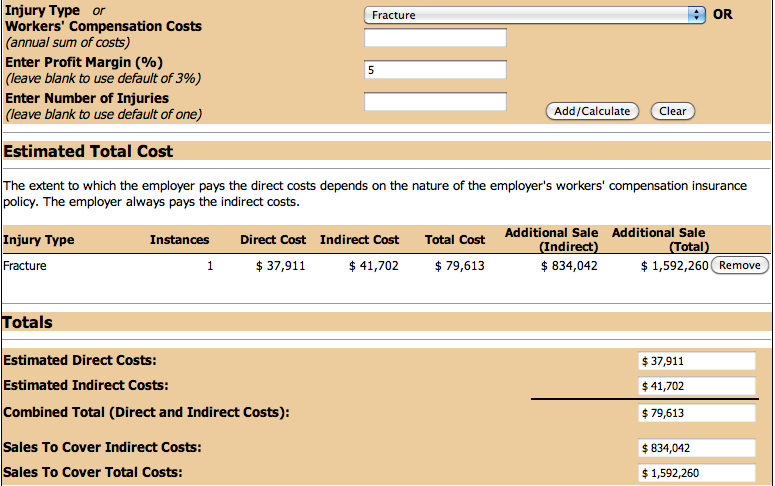

Studies show that a good safety and health program can save $3 to $6 for every $1 invested. We found a neat little tool that OSHA put out to estimate the approximate cost, including direct and indirect costs, of a workplace injury. They researched the average direct costs as well as medical and indemnity payments of a variety of different injuries, and use a multiplier of those costs to determine the indirect costs of those injuries as well. The calculator then shows how much additional revenues need to be earned to make up for those expenses based on the profit margin of the company.

The results are very interesting. For example, we plugged in a simple bone fracture as the injury (there are much worse examples you can choose on their list) and used a company profit margin of 5%. The estimated total costs, direct and indirect, for this injury came to $79,613. At a 5% profit margin, this company would have to generate and additional $1,592,260 in sales to cover those costs to the bottom line! And that’s just one broken bone! You can check out this calculator on OSHAs website and input a variety of injuries, or even workers comp costs, as well as your company’s profit margin to come up with costs more accurate to your business.

You will notice that indirect costs make up a large portion of the overall cost and can vary depending on the industry and individual business. These indirect costs are important to note because they are usually uninsured and therefore, unrecoverable. Examples of indirect costs include:

- Wage costs from time lost through work stoppage

- Administrative time spent on accidents

- Employee training and replacement costs

- Lost productivity from new employee learning curve or injured employee accommodations

- Replacement costs of damaged material, machinery, or property

- Wages paid to workers for absences not covered by workers’ comp

- Increased insurance premiums

- Potential fines from regulatory agencies

- Law suit defense

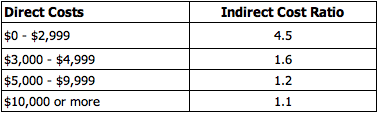

The multiplier that OSHA used to provide indirect cost estimates are based on a study conducted by the Stanford University Department of Civil engineering. This study states that the less serious an injury, the higher the ratio of indirect to direct costs is – in other words, the indirect costs of a less serious injury can be 4 to 5 times the amount of the direct cost.

Information on the direct costs of an injury was derived from the National Council on Compensation Insurance, Inc data. Direct costs are easily trackable and include things like medical treatment, lost time wages, and property damage.

It’s always difficult to see the crisis avoided or injury prevented due to training and preparation. By showing it in hard numbers, a tool like this can really put the costs in perspective. Think of it like insurance. Would you risk owning a home without homeowners insurance? If something was to happen and you lost an uninsured home, the financial impact to you would be devastating. Home insurance is a protective investment; it protects you, financially, in the event of a loss of one of your biggest assets.

An investment in safety is the same. You are protecting the most important asset to any business – it’s employees. And as you can see from the numbers above, a serious injury, or the death of an employee can have a devastating financial impact. Try to remember that the next time safety budget cuts are being considered.